Slowly but surely investors are coming round to the idea that we really are living in a ‘new normal’ low interest rate environment. Investor requirements haven’t changed as they continue to look for diversification and wealth preservation, however they have become disillusioned with the opaque nature of financial engineering and complexity when it comes to investing. At the same time investors are dissatisfied with the low yields on traditional fixed income but tend to be hesitant about turning their attention to equities as an alternative.

At the same time. as a result of the Financial Crisis, banks have had layer after layer of regulation heaped upon them and as such have shied away from entering into Trade Finance with certain counterparties. Banks are now more likely to lend to large commodity trading institutions rather than entering into transactions with ‘real firms’ delivering ‘real goods’.

As a result investors are beginning to look towards Trade Finance as a source of income return. This prima is designed to help explain the asset class, illustrate the risks and highlight the opportunity for income-searching investors.

What is Trade Finance?

Trade Finance is as old as commerce: in its most basic form it is when a lender provides financing specifically linked to a trade transaction as opposed to the general credit of the borrower. It is the bread and butter activity of most commercial banks across the globe. According to the World Trade Organisation, an estimated 90% of world trade is financed, making it likely that many of the everyday goods we rely on have benefited from financing.

When international trade occurs there is often a time lag between the shipment of goods by the exporter and their receipt by the importer. Normally exporters require payment when they release the product however the importers will pay for the goods on arrival. In the simplest form this time lag is financed by banks with the collateral being the physical goods. In most cases Trade Finance is conducted in US dollars.

The Trade Finance Market

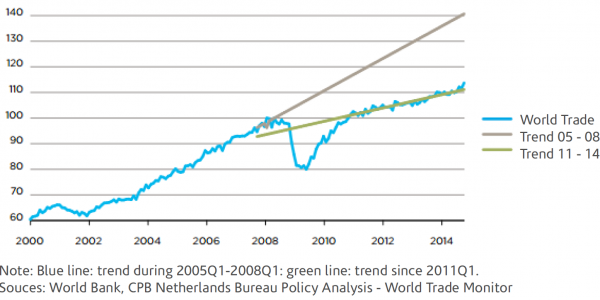

Global trade growth has generally been sluggish since the Financial Crisis. Weak economic growth during this period, especially in advanced economies, is widely seen as a key explanatory factor.

Figure 5: Global Trade Volumes

Index = 100 in 2008

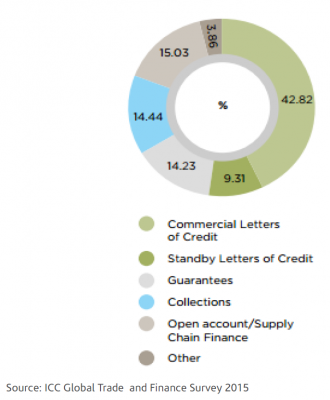

Structured trade finance provides solutions for non-standard transactions, tailored around specific transaction features and this requires specialist credit skills. A typical transaction involves a shipment of tradable commodities or goods, a seller, a buyer, and a lender. The lender advances asset-backed financing to the seller (supplier) with the shipment as collateral. These transactions are generally undertaken via letters of credit that are issued by the lending institution. The success of the transaction depends on the seller successfully delivering the shipment to the buyer and the buyer making the payment. The price of the transaction is fixed in advance. Should the delivery or payment fail, the lender is entitled to sell the shipment to recover the advance. The quality of a trade finance transaction lies primarily on the commercial credibility and operational reliability of the borrower, the nature of the transit involved and the collateral shipment.

Figure 18: Import Trade Product Mix

Low historic default rates

Unlike the traditional corporate bond market, obtaining figures on the comparably low default rates for trade finance is more challenging. The most comprehensive study on default rates for trade finance comes from the International Chamber of Commerce (ICC). Their work began in 2009 at the peak of the global financial crisis based on the initiative of the Asian Development bank. In the 2015 Trade Register Report it is contributed to by 23 banks, covers 13mm transactions and represents a total exposure of $7.6bn.

The ICC concludes that Trade Finance experiences low default rates across all products – both at the customer and the transaction level, in fact only reaching one tenth of comparable Moody’s default rates. These very low default rates could be a result of the improved alignment to Basel lending accords.

It is important to understand that there are three counterparties in trade finance and none of the parties have an incentive to default. If any counterparty defaulted it would result in significant negative effects on their business.

Figure 39: Customer Default Rates Regions and Products, 2008-2014.

Default rates in Trade Finance as a result of recent swings in commodity prices and currencies

Overall trade finance activity increased over 2015. The automatic assumption is that this is a result of increased underlying trade. Whilst that might be some of the story the primary driver for increased activ-ity is the real or perceived risk being faced by trading counterparties. The recent falls in commodity prices have had an immediate negative effect on banks outstanding trade finance obligations when securing such transactions.

With many currencies currently tending towards decline, the feature of commercial letter of credits when issued irrevocably fixes the payment and currency amount to be paid, before the goods are actually shipped. These letters of credit are predominantly issued in US dollars. Once issued, the amount and currency to be paid is irrevocably fixed for the beneficiary. Should the currency of the importer decline in the interim period before maturity the beneficiary must be paid by the bank in the currency and amount available under the credit as originally issued.

Both currency and commodity volatility have increased the risk of default or a renegotiation of commercial contracts. There might be consequences on the viabilities of counterparty’s business models with fast declines in local currency values. Notwithstanding these challenges banks still maintain a steady capacity to satisfy trade finance needs.

The emergence of non-bank Alternative Income players

One of the major trends noted in the ICC report on Trade and Export Finance was the emergence of non-bank Alternative Income players. Private funds are becoming more prominent as barriers to entry fall and regulations favour non-banks for some asset classes.

While non-bank players have always been a part of the Trade and Export Finance landscape, they have become more prominent in recent years. These players span a wide range of services, from lending (most commonly Receivables Finance), to logistics, platform and technology provision, Insurance and other products and solutions linked to Trade and Export Finance. Previously, the lack of a distribution channel held back their uptake by corporates. However, as more transactions go online, this barrier to entry has lowered, allowing more non-bank Alternative Credit players to access potential clients more easily.

In addition, Basel III liquidity requirements have made certain asset classes less expensive to house on a non-bank balance sheet. This shift in the relative attractiveness of holding assets on bank vs. nonbank balance sheets, combined with a hunt for low risk investments with good yields, has also led to investors coming into the picture and some asset managers and hedge funds have started looking at trade assets as a potential investment class.

In certain niche areas, teams of ex-bankers backed by private capital operate as alternative lenders. They focus on transactions where banks do not have the flexibility or risk tolerance to finance. The most straightforward opportunities relate to small size transactions and cases where the borrower has used up its bank credit lines. Alternative lenders can have the flexibility and expertise to finance non-standard shipments, for instance agricultural products not traded on a commodity exchange, or fast moving consumer goods; their skill lies in identifying and pricing the liquidity alternatives. Alternative lenders can have the flexibility to finance transaction in countries or sectors that banks avoid as matter of firm-wide policy; their skill is to correctly assess the political risk, operational risk or other specific risk, and mitigate it by tailored struc-turing and operational planning.

Technological advances are reducing the barriers to entry

Several non-bank players are coming up with innovative solutions which address customer needs in a better/cheaper way than solutions provided by banks. These non-banks have an alternative capital structure and the funding is appearing via institutional mandates, hedge funds and other private sources of funds.

The key to the success of a transaction is in the quality of the documentation. Many transactions are now being completed online and as such historic barrier to entry falls away opening up this market to private funding.

Risk considerations:

All types of trade transactions carry an inherent degree of risk. The level of risk assumed by different trading partners is dependent on the terms of the transaction and the payment and settlement mechanism that is agreed upon.

On top of general counterparty risk there are a number of other key risks that are inherent in international trade. These include political and country risk, bank risk, operational risk and currency risk. If any of these risks spill over they will all impact the already thin profit margins earned through the finance of trade.

Buyers generally are obliged to pay for the goods in advance of receiving them. If the goods do not meet the required standard or quality then this affects the success of the transaction.

As the terms of trade are fixed in advance, the lender has no direct exposure to the price of the collateral commodity. However, a sharp decline in a commodity’s price increases the risk of an off-taker ‘walking away’, or reduces the proceeds of a sale of collateral if the borrower defaults. The lender will mitigate the risks of a decline in the collateral value by having covenants requiring additional margin.

Controlling the collateral is critical and the main operational risk factor. Third party certification agents such as Veritas verify the quality of the shipments as the goods move from seller to buyer.

The casualty risks during transportation or warehousing are typically insured. However, the political and government level risks are not covered by these contracts: exports or imports bans, border closures, security disruptions. Such events can result in the loss of the shipment, but this rarely happens as trade financing usually occurs on the most common trade routes. Sometimes, however, these disruptions can lead to re-routing and delays, impacting the return to the seller and increasing the risk of the buyer refusing the shipment.

The risk of a trade finance transaction lies in the characteristics of each specific transaction rather in the general credit of the borrower or purchaser. Given the dynamic and idiosyncratic nature of international trade transactions the quality of the trade financing transaction documentation serves as a key risk management tool to ensure that it proceeds in the most efficient manner.

As an investor. fund manager or bank the most important risk management tool is to diversify one’s exposures. To capture the Trade Finance risk premium one can achieve this through investing in a fund but one should ensure a strong and experienced management team. One has to be aware of the aforementioned risks and to ensure these exposures are diversified through investing in multiple contracts.

Summary

Like any asset class one can capture returns at either end of the risk spectrum. Despite the risks the ICC can demonstrate that general Trade Finance offers a low and attractive risk profile relative to other asset classes. As it can be shown, default rates are relatively low, the products are short term and losses (defaults) are relatively low.

As we discussed, market trends are opening up the returns that were historically only available to banks and institutional investors are now available to private investors via new fund structures. In a world dogged by low interest rates and efficient markets, investors can now consider investing in Trade Finance funds to capture income returns.

As this asset class is emerging for individual investors the vehicles and funds used to capture the returns are also relatively new. Care and attentions should be taken before investing and significant due diligence should be undertaken before making an investment decision.

Risk Warnings

Investing in this asset class is for Sophisticated and Certified High Net-worth Investors. Always consult a Financial Adviser before making a decision to invest. Past performance is not a reliable indicator of future performance. Currency fluctuations may increase or decrease the returns of any investment. The value of investments can fall as well as rise. You may not get back what you invest. This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.