Diversification is one of the most important aspects when investing and this is no exception in Alternative Credit. Diversifying your investments in Alternative Credit is a lot harder to achieve than in many other more liquid and mature asset classes. Here are some ways in which you can achieve this.

As I wrote in an earlier article1, since the GFC, interest rates across the developed world have been low much longer than expected. Since then there have been many regulatory and business changes and investors need to look further afield in search of yield. Alternative Credit has been quietly filling that void for some investors for many years and is now just starting to hit the mainstream. Nowadays it is easy to get access to P2P consumer loans through Lending Club, RateSetter, Zopa or other platforms and it is easy to diversify lending across multiple loans in small amounts. But how much does this really reduce risk? We all know from Harry Markowitz that diversification is one of the only free lunches in investing and that investing in non-correlated investments can reduce risk. This second point is where many alternative credit investors fail.

It is easy for investors to diversify out their ‘loan specific risk’ by making hundreds of loans on a platform as opposed to a small handful. The P2P consumer lending platforms have been very good at helping investors do this over the past number of years. That is a good first step, but it is not enough. What happens if the lending standards on a platform drop significantly or there is fraud or some other unanticipated event?

Lending out money on multiple P2P consumer lending platforms reduces ‘platform risk’ which is sensible but still not enough. Investors who are trying to spread their risk by making P2P consumer loans on multiple platforms still have too much risk in one asset class. I saw a similar situation occur in the late 90’s when I was managing stock option plans at Smith Barney in New York. We had employees who would reduce their ‘company specific risk’ (which is akin to ‘platform risk’) by selling their Cisco stock options but then using the proceeds to buy shares in Lucent or Nortel. This failed when all networking and technology stocks fell significantly at the same time. In Brinson, Singer and Beebower’s research papers on asset allocation from the 1980’s, they confirmed that the decision about which asset class to invest in is more important than the individual stocks you buy. They showed us that asset allocation is many times more important than stock picking or market timing, which is also true in alternative credit. What happens if all unsecured consumer P2P loans start to default because of a macro or micro economic event? This would lead to big losses, like when many sub-prime mortgages started to default at the same time less than 10 years ago.

Another problem many alternative credit investors encounter is that most only lend in their own country. This is known as ‘home country bias and concentrates risk in one currency, political environment, regulatory environment, market environment, etc. Investing in multiple countries will diversify away many of these and other unexpected risks. The problem is that most individual investors cannot access foreign lending markets due to tax, regulatory or practical issues such as getting access to loans from abroad.

That being said, applying sensible portfolio management techniques, I have taken a very different approach both personally and with clients when investing in alternative credit. In order to be successful, it is my opinion that you need to be able to make many loans in many asset classes, through many platforms (or directly) and in multiple countries. MASECO Asset Management has investigated many global opportunities and at the moment, invests in commercial mortgages, loans against life insurance, trade finance loans, leasing, loans to SMEs and P2P consumer loans (although they are not making new loans in this area) in more than 12 countries on 3 continents. As you can see there should be very little correlation between trade finance loans in South Africa, SME loans in the US, leasing in Spain, loans against life in the US and real estate loans in Canada. But why is this?

The drivers behind the lending rates and default rates in these different investments is what gives us confidence that they will have low correlation when (not if) one of these market segments falters. For example, regional and large banks in the US have decreased their SME lending dramatically since the GFC and the platforms have increased their footprint significantly over this period. Based on my experience, net returns in the US are higher than in the many European countries and the UK in this asset class. For our US investors we invest in USD in this market segment and for GBP investors we simply hedge out the foreign exchange risk for them.

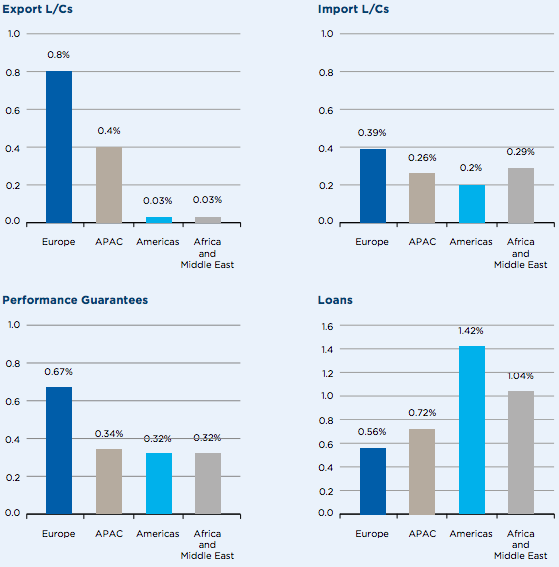

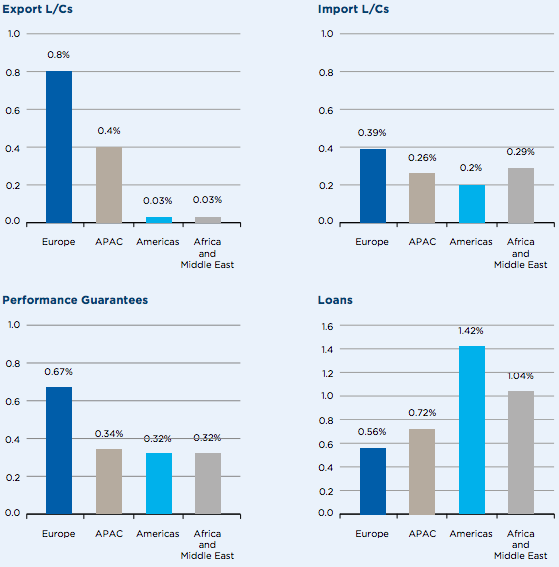

In South Africa, big banks have stopped writing letters of credit to many former clients and private capital can now enjoy a very health premium for lending in this space. As Barclays and Standard Bank retrench whilst many African economies continue to grow at very healthy rates, the demand for capital has increased and the supply decreased. Letters of credit default rates in Africa are actually much lower than in Europe (according to the ICC), yet the rate of interest lenders can charge is much higher.

Customer Default Rates Across Regions and Produce

Source: International Chamber of Commerce (ICC), “Rethinking Trade & Finance”, 2015

In Canada there are only five big banks and they dominate the banking landscape. If a borrower cannot meet their strict criteria they won’t lend to them. This has created a large opportunity for clever borrowers to make a decent return. This has been going on for decades and I suspect it will for many more.

Loans against life insurance is also an underserved community where you can enjoy healthy lending premiums. Many lenders cannot accept the unknown duration of these loans so they cannot hedge out their duration risk. Private capital who doesn’t mind having a portion of their assets in illiquid, loans with unknown duration can receive double digit returns whilst maintaining a high credit quality portfolio.

So as you can see, in order to diversify in alternative credit, it is important to diversify to significantly reduce your risk whilst seeking a high level of return. By investing in thousands of loans from multiple platforms, across multiple asset classes in multiple countries, an investor can diversify out many risks and sleep better at night while receiving a healthy income.

Josh Matthews is the co-founder of MASECO LLP in London. Josh is also the Fund Architect of MASECO Asset Management’s two Alternative Credit Funds. Prior to co-founding MASECO LLP, Josh was a Director in Citigroup’s Private Client Group in London and a Senior Vice President at the predecessor firm Salomon Smith Barney in New York City. Josh is a UK Founding Member of B Corp and MASECO Private Wealth was the first financial services company in the UK to become a B Corp.

MASECO Asset Management Limited is a separate and independent entity from MASECO LLP and any other entity of a similar name.

1. Why the opportunity in alternative credit is far broader than just p2p.